With certain student loan payment requirements set to resume after a nearly four-year pause, the Federal Reserve Bank of New York found this may not result in a significant impact on the economy. However, borrowers have taken on more debt burdens since the COVID-19 pandemic. Despite the relief the government provided during Covid, all this debt combined results in challenges that there may now be additional payments unaccounted for within an individual’s current budget.

While most student loan debt is not dischargeable, bankruptcy may provide relief for other debts and eliminate the need to take on more credit card debt or personal loans. This is especially true for those facing any of the circumstances outlined in this recent Yahoo! article that detailed the Fed’s study and other reports related to the economic impact when payments resume for thousands of individuals.

The Fed’s study found borrowers would reduce their spending by an estimated $1.6 billion per month as student loan payments resumed, which is only a 0.1% decrease from August spending, but the study also predicted that delinquency rates on student loan debt would return to pre-pandemic levels.

Despite the lower impact on the broader economy, individual borrowers may be faced with more challenges. The study found that 22.6% of borrowers felt there was a possibility they would miss an upcoming student loan payment. A separate survey by New York Life in September 2023 found that 27% of borrowers felt unsure of how they would even be able to repay their loans once payments resumed.

There is also potential for borrowers to miss payments on other outstanding debts. The New York Life survey found there was an 11.8% increase in those who felt they would struggle with other financial burdens, especially as many borrowers have more debt than they did prior to the payment pause.

Of those surveyed in a TransUnion study, 53% of borrowers took out a new credit card since the payment pause and 36% took on a new auto loan. Fifteen percent now have mortgages and personal loans added onto their list of monthly payments, as well. In some cases, borrowers might have a larger combination of all of these regular bills.

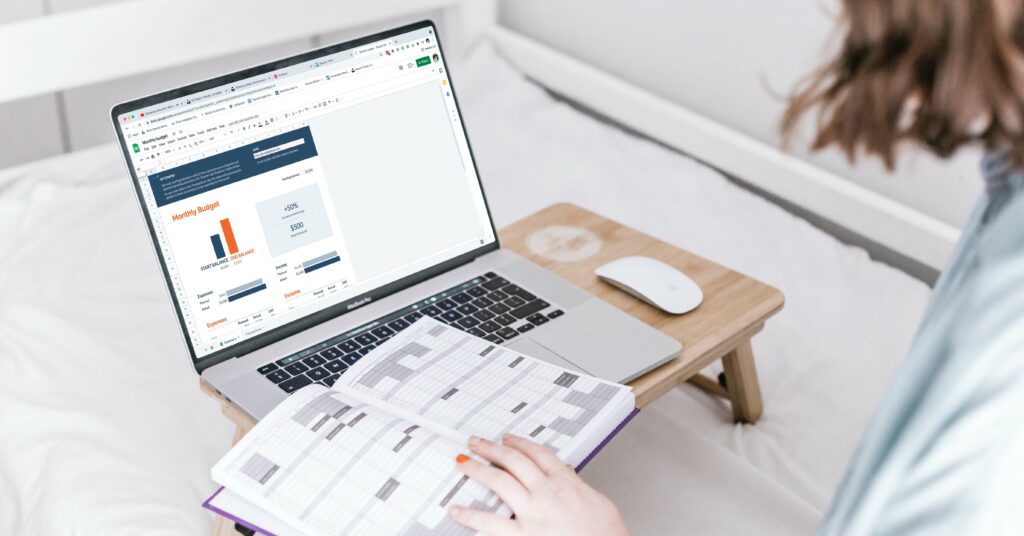

The additional monthly payments may lead to stress and uncertainty for many individuals as they attempt to integrate student loan payments into their monthly budgets.

On top of adding another payment to their budget, many consumers do not feel that they have all the information they need to begin their repayments. In a survey by the Student Debt Crisis Center, only 20% of borrowers felt they had all the information they needed to prepare for payment resumption.

If student loan repayments are adding more to your monthly payments than you can handle, bankruptcy may be an option to help you on your path to a more secure financial future. Contact a member of our team at Sader Law Firm today at (816) 561-1818 for a free phone consultation and information on what options will work best for you.

Book an

Book an Email

Email Directions

Directions