George W. Bush signed the College Cost Reduction and Access Act (CCRAA) into law in 2007. The CCRAA created the Public Service Loan Forgiveness Program (PSLF), which allows some federal student loan borrowers working at qualifying public service jobs to receive tax-free loan forgiveness.

Student loan borrowers qualify for forgiveness under PSLF if they meet the requirements—for which there are many. Unfortunately, student loan servicers and the Department of Education failed to effectively communicate these requirements to borrowers. Many borrowers who believed they were eligible for PSLF forgiveness are finding out their loans or jobs never qualified. As a result, some borrowers have made the required ten years of payments only to find out their loans were never eligible for forgiveness.

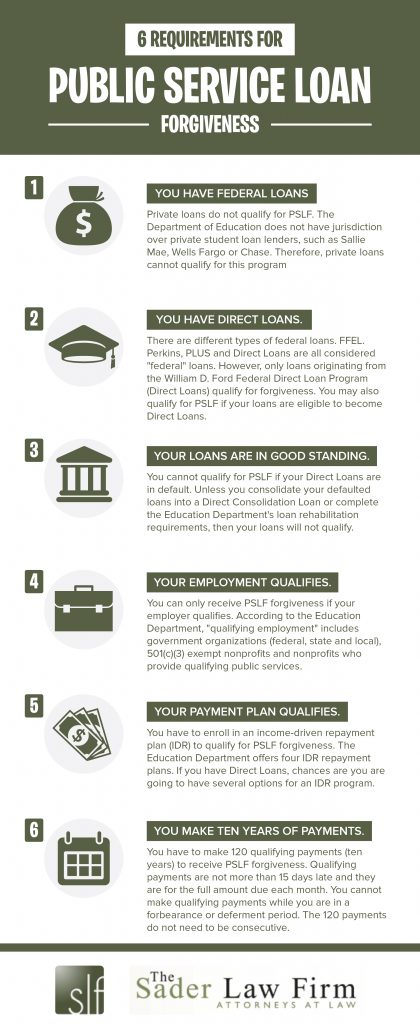

You can only receive PSLF forgiveness if you meet the following requirements:

Requirement #1: You have federal loans.

Private loans do not qualify for PSLF. If you are thinking about enrolling in PSLF and have private loans, you will not qualify. The Department of Education does not have jurisdiction over private student loan lenders, such as Sallie Mae, Wells Fargo or Chase. Therefore, private loans cannot qualify for this program.

Requirement #2: You have Direct Loans.

There are different types of federal loans. FFEL, Perkins, PLUS and Direct Loans are all considered “federal” loans. However, only loans originating from the William D. Ford Federal Direct Loan Program (Direct Loans) qualify for forgiveness.

Requirement #3: Your loans are in good standing.

You cannot qualify for PSLF if your Direct Loans are currently in default. Unless you consolidate your defaulted loans into a Direct Consolidation Loan or complete the Education Department’s loan rehabilitation requirements, then your loans will not qualify.

Requirement #4: Your employment qualifies.

You can only receive PSLF forgiveness if your employer qualifies. According to the Education Department, “qualifying employment” includes government organizations (federal, state and local), 501(c)(3) exempt nonprofits and nonprofits who provide qualifying public services. You should get into the habit of certifying your employment with FedLoan Servicing (the student loan servicer that handles PSLF for the Education Department) each year.

Requirement #5: Your payment plan qualifies.

You have to enroll in an income-driven repayment plan (IDR) to qualify for PSLF forgiveness. The Education Department offers four IDR repayment plans. If you have Direct Loans, chances are you are going to have several options for an IDR program.

Requirement #6: You make ten years of payments.

You have to make 120 qualifying payments (ten years) to receive PSLF forgiveness. Qualifying payments are not more than 15 days late and they are for the full amount due each month. You cannot make qualifying payments while you are in a forbearance or deferment period.

Other Reasons Why PSLF Forgiveness Is Extremely Rare

It takes dedication to meet the requirements for public service loan forgiveness; only 1 percent of PSLF applicants are successful in getting their loans paid off because each year, you must take steps to ensure you meet the requirements for the program. Next month’s blogs will describe the steps you need to take each year to ensure you qualify by the time you make your 120th payment. Be sure to check in with The Sader Law Firm on Twitter and Facebook for future blog updates.

Kansas City Student Loan Attorneys with Experience

The Kansas City student loan attorneys at The Sader Law Firm can answer questions you have about repayment or forgiveness. Reach out to us by calling (816) 561 1818 or using our online contact form.

Book an

Book an Email

Email Directions

Directions