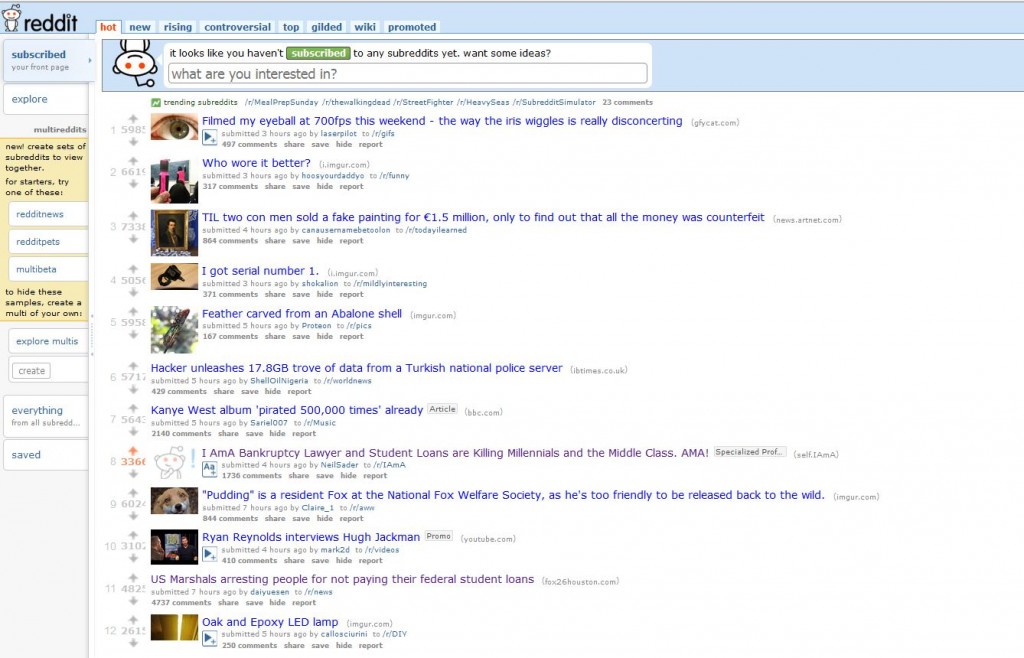

Bankruptcy attorney Neil Sader recently hosted an AMA on Reddit, drawing in thousands of people to comment on their experiences with student loans. The AMA, which made it to the front page of Reddit and in the top 10 posts, received 5,000 comments that tell us a lot about the student loan crisis.

As Neil said, “bankruptcy is for the honest debtor.” For millions of former students and graduates, they do not have access to normal bankruptcy protections, even with honest intentions. While it is difficult to file for bankruptcy on student loans, it is not impossible. Under certain circumstances, debtors can receive hardship discharges (see totality of circumstances test). For others, the chances of discharging student loans will be slim.

Politicians, academics and other bankruptcy attorneys should skim through this AMA, read some of the stories Reddit users have posted, and ask if it is fair to deny these people the chance to file for bankruptcy.

We have allowed for-profit universities and many other colleges to lure in people with promises of wealth and success, only to put them in positions post-graduation where paying off debts are extremely unlikely. Some universities have even been caught falsifying post-graduation employment statistics to attract new students. After graduating, our current bankruptcy laws deny these people any chance of living normal lives.

We Need to Restore Bankruptcy Protections for Student Loans

If someone made the mistake of attending a for-profit university or chose a major with little economic value, they should be given the chance to start over. Financial mistakes should not be permanent and follow borrowers around forever. We give consumers, business owners and those with medical debt the opportunity to file for bankruptcy. Why continue denying former students and graduates that same opportunity?

Some unlucky people will see compound interest grow their loans into the hundreds of thousands of dollars, or even close to or above $1 million.

If we do not restore normal bankruptcy protections for student loans, it could deter future generations from attending higher education. Imagine what would happen if we took away Chapter 11 bankruptcy protections for businesses. Who would start a business? The risks would be catastrophic and permanent if businesses were to face tough economic times.

Hosting this AMA allowed thousands of people to share how student loans have affected their lives. We need to pay attention to these stories and ask ourselves how we can create solutions to the student loan crisis.

Book an

Book an Email

Email Directions

Directions